| |  |  |  |  |  |  | |  | |  | |

| |

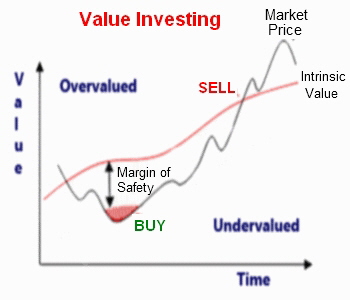

There is a fundamental difference between basic value and market price. Values can be analyzed and tested by statistical and mathematical measurements. While emotional factors and surprise news and other developments often temporarily upset the relationship between price and value, eventually the two become correlated.- SmartValue are strong advocates of basing investment decisions on thorough calculations and studies of value rather than wasting time guessing and speculating whether prices or the stock market will be higher or lower next week or next month or next year.

- Bear markets have always been temporary. Share prices and good investments turn upward from one to twelve months before the bottom of the business cycle.

- Share prices fluctuate much more widely than values. Therefore, index and growth funds will never produce the best total return performance over time. Too many investors focus on “outlook” and “trends.” Yet, more profit is made by focusing on value.

- If you search worldwide, you will find more value and better opportunities than by studying only one nation. Also, you gain the safety of diversification.

- Buy relative value (ie., book values, cash flows and earnings growth) at a reasonable price.

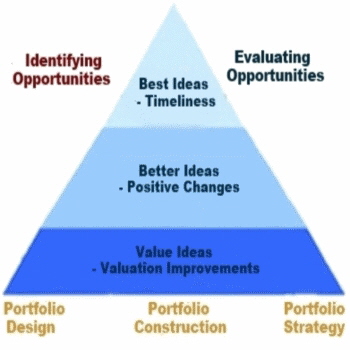

- Over-diversification is the greatest enemy of portfolio performance. Most portfolios have too many securities. As a result, the impact of a good idea is negligible. Moreover, the greater the number of securities in the portfolio the more difficult it is for the investment manager to stay on top of developments affecting these securities.

- The risk of paying too high a price for good-quality securities—while a real one—is not the chief hazard confronting the average investor. Observation and experience over many years has taught us that the chief loses to investors come from the purchase of low-quality securities (poor value) at times of favorable business conditions. The investors view the current good earnings as equivalent to “earning power” and assume that prosperity is synonymous with safety.

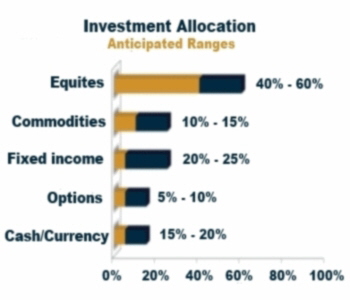

- Selective asset allocation and diversification is the most important secret of successful investing. It's the only way to avoid having all your eggs in the wrong basket at the wrong time. No one has a crystal ball, but professional portfolio management increases your chances of success.

- Don't follow the crowd. If you buy the same securities as other people, you will have the same results as other people. It is impossible to produce a superior performance unless you do something different from the majority. Value Investing is the better choice.

- If you know about it, everyone knows about it. Too many people make the mistake of buying something they know well - a chain of stores, or a product that's doing very well. Remember the principle of doing something different from other investors - if you know about it, the chances are that everyone else knows about it too, and that means the share price will be high. Don't buy shares when prices are at historical highs, no matter how good the company's performance appears to be - don't pay too much. Look for shares that everyone else is ignoring, that aren't the rage today, and buy those you think have a reasonable chance of coming back. Buy value, not price.

- Rely on professional money managers. This is almost unavoidable these days if you want to do a good job with investments. Years ago there were not many companies, stocks, and other factors to study.

- Mutual funds must be purchased selectively from the thousands available. Mutual funds have two great virtues: they provide that vital diversification, and the investment decisions are made by experts. However, not all mutual funds or experts are equal.

- A good track record is a lot harder to achieve than most people think. An investor who has all the answers doesn't even understand the questions. The skill factor in selection is terribly underestimated, and is most important for your portfolio. The value of a security is not what it did, or what it's doing now, but what it's going to do one, three, and five years in the future.

- SmartValue does not make hasty, emotional decisions about buying and selling securities. SmartValue weighs the pros and cons objectively.

- SmartValue does not concern itself as much with the market in general as with the outlook and value of individual investments.

- SmartValue does not make decisions on stock market “tips” or speculation. SmartValue uses good judgment and reliable research and other information.

- There is no reason to always be fully invested in the securities markets. After the securities markets have had a sizable advance, SmartValue is wise enough to take profits.

- Always remember that the “public” is generally wrong on investment matters. The masses are not accurately informed about investments and the markets. They have not learned a disciplined investment approach or disciplined themselves correctly to make the right choices in the right industries at the right prices. They are moved mainly by their emotions, and history has proved them to be wrong consistently.

- SmartValue does not follow stock market “fads” or “the herd.” When you buy securities at the height of popularity you almost always pay prices that have little relationship to value.

- SmartValue focuses its energy and time on where a security is going rather than on where it has already been. The important thing is what lies ahead, not what has already transpired, and previous security prices and trends have no bearing on the future.

- SmartValue thinks that investment success will not be produced by arcane formulas, computer programs or signals flashed by the price behavior of securities and markets. Rather an investor or investment manager will succeed by coupling good business judgment with an ability to insulate his/her thoughts and behavior from the emotions that swirl about the investment industry and marketplace.

| | |  | |

SmartValue Investment Management LLC © 2005 - 2023

|